01

Strong positions in growing markets

STRENGTH

Majority three player markets, all growing over the last three years. Vodafone is also growing faster than the market in most regions.

€ 57 BN

Germany

+1.7%1

€ 50 BN

UK

+2.7%

€ 23 BN

Other Europe

+1.6%

€ 9 BN

Türkiye

16.9%

€ 17 BN

Africa

+10.2%

- Growth rate over a 2-year period (2022-2024)

02

Focus on driving operational excellence

FOCUS

Vodafone is right-sized for growth and reorganised for operational excellence.

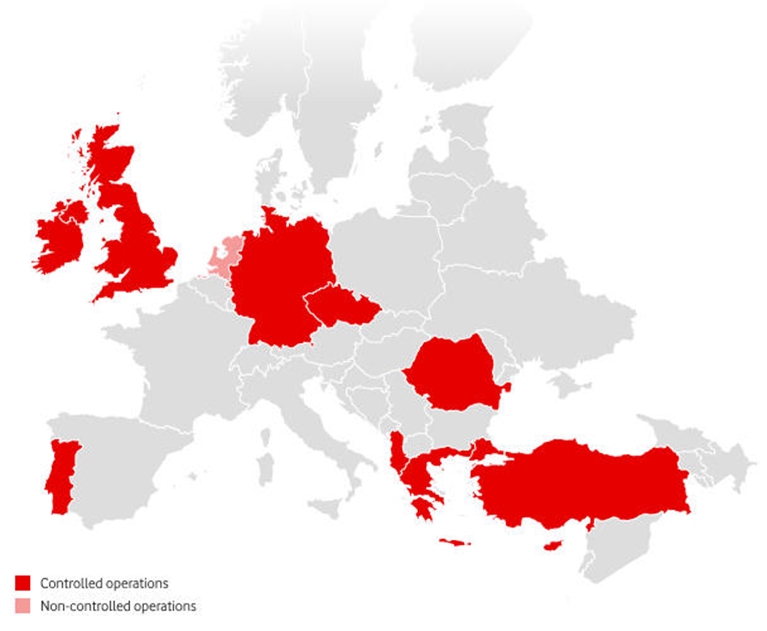

9

countries

112 M

mobile customers

19 M

fixed customers

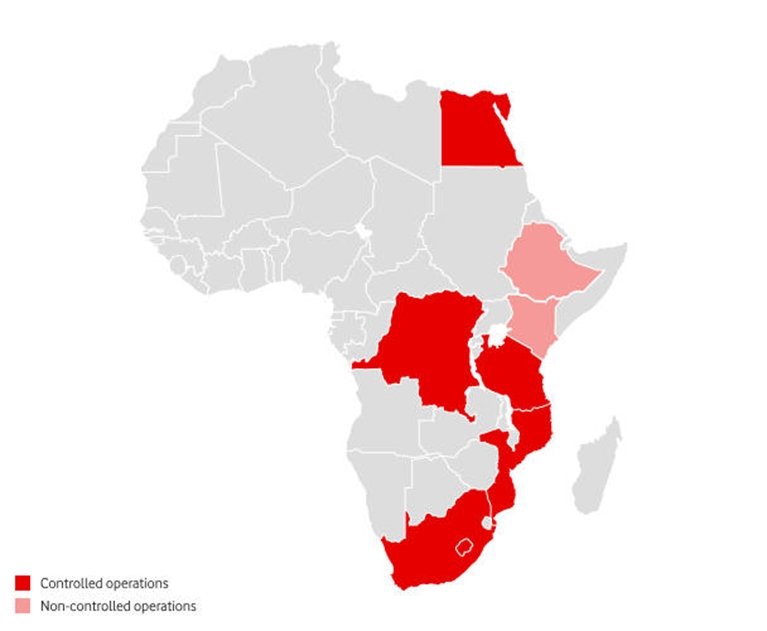

8

countries

227 M

mobile customers

92 M

financial services users

Investments

Operations

Infrastructure

Innovation

Partner markets

03

Sustainable and predictable financial profile

SECURITY

04

Structural growth drivers

GROWTH

Digital service growth +14%

We serve private and public sector customers of all sizes with a broad range of connectivity services, supported by our dedicated global network. We have unique scale and capabilities, and are expanding our portfolio of products and services into growth areas such as unified communications, cloud and security, and IoT.

Daily mobile money transaction value $1.2bn

We provide a range of mobile services. The demand for mobile data is growing rapidly driven by the lack of fixed broadband access and by increased smartphone penetration. Together with Vodacom’s VodaPay super-app and the M-Pesa payment platform, we are the leading provider of financial services, as well as business and merchant services in Africa.

Investment and innovation

Our non-controlled operations are managed centrally through Vodafone Investments, reflecting that these assets need a different governance and oversight structure to support their growth and maximise value creation.