Capital allocation principles

In March 2024, we conducted a broad capital allocation review, considering the Group's strategy within its reshaped footprint. This review has concluded the following key outcomes:

- Investment: Following an extensive review of our capital investment requirements, the current capital intensity will be broadly maintained at a market level, which will allow for appropriate investment in networks and growth opportunities.

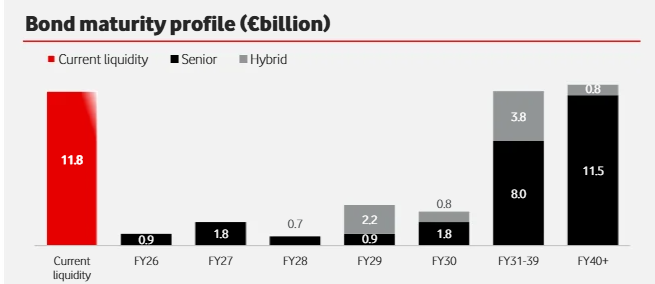

- Leverage: A new leverage policy of 2.25x – 2.75x Net Debt to Adjusted EBITDAaL and we target to operate within the bottom half of this range. The leverage policy supports a solid investment grade credit rating and positions Vodafone to continue to invest for growth over the long-term.

- Shareholder returns (dividends): The Board determined to adopt a new rebased dividend from FY25 onwards. The Board has declared total dividends of 4.5 eurocents per share for FY25 with an ambition to grow it over time.

- Shareholder returns (share buybacks): During FY25, the Board approved a capital return through share buybacks of up to €2.0 billion of the proceeds from the sale of Vodafone Spain. A new share buyback programme of up to €2.0 billion of the proceeds from the sale of Vodafone Italy has started, with the first €500 million tranche commencing on 20 May 2025. Total capital returns to shareholders in FY25 were €3.7 billion.