M-Pesa’s biggest market is in Kenya. Picture credit: Vodafone Group

An international team of Vodafone experts has carried out a large-scale investigation into the adoption and use of the M-Pesa mobile money service in a developing economy.

That evidence is now helping them build a machine-learning model that predicts how and where to deploy M-Pesa, and could contribute to improving the economic prospects of disadvantaged populations.

Mobile money has had a tremendously positive impact on people’s lives, increasing financial inclusion and economic growth, absorbing financial shocks and reducing poverty.

A recent study estimated that M-Pesa has lifted 2% of Kenyan households out of poverty. In 2017, 277 mobile money services were active worldwide, 35 of which had more than a million customers.

An M-Pesa mobile money agent in Tanzania. Picture credit: Vodafone Group

Yet despite the success of mobile money services, there has been little quantitative, large-scale research into the factors that play a role in their adoption and usage with the aim of providing companies with large-scale, data-driven models they can use to improve the design of services in developing countries.

Now the first study of its kind - carried out by an international team of researchers including experts from Vodafone and the University of Trento in Italy - has sought to fill this gap by analysing 140 million pseudo-anonymised mobile phone records and more than 27 million M-Pesa transactions over a six-month period in an African country.

There were several implications for the design of mobile money services in this first market:

Money transfer prevails – despite the plethora of financial services available via mobile money, the most frequently performed transactions in the country of study were related to the original purpose of M-Pesa: money transfers.

Single purpose prevails – the research found that that almost two-thirds (65%) of customers only used M-Pesa for one purpose, with 89% of those transactions involving sending money to another customer or depositing money with an agent.

Money travels further than calls - by comparing phone records (which showed 63% of calls took place locally) with M-Pesa transactions (where 72.5% were inter-district), another discovery was made: money is flowing at longer distances when compared to mobile phone calls.

Mobile money accounts are associated with a SIM card, making it a powerful driver of financial inclusion. Picture credit: Vodafone Group

Taking these three findings into account, the team concluded that money transfer across long distances seems to be the key unmet need that these services fulfil in this country.

Their analysis also confirmed the findings of previous studies that showed how mobile money contributes to economic development by enabled the transfer of money from richer urban areas to poorer rural areas.

Armed with this data, the research team also used machine learning techniques to build a model that would predict future M-Pesa adoption and intensity of usage three months into the future.

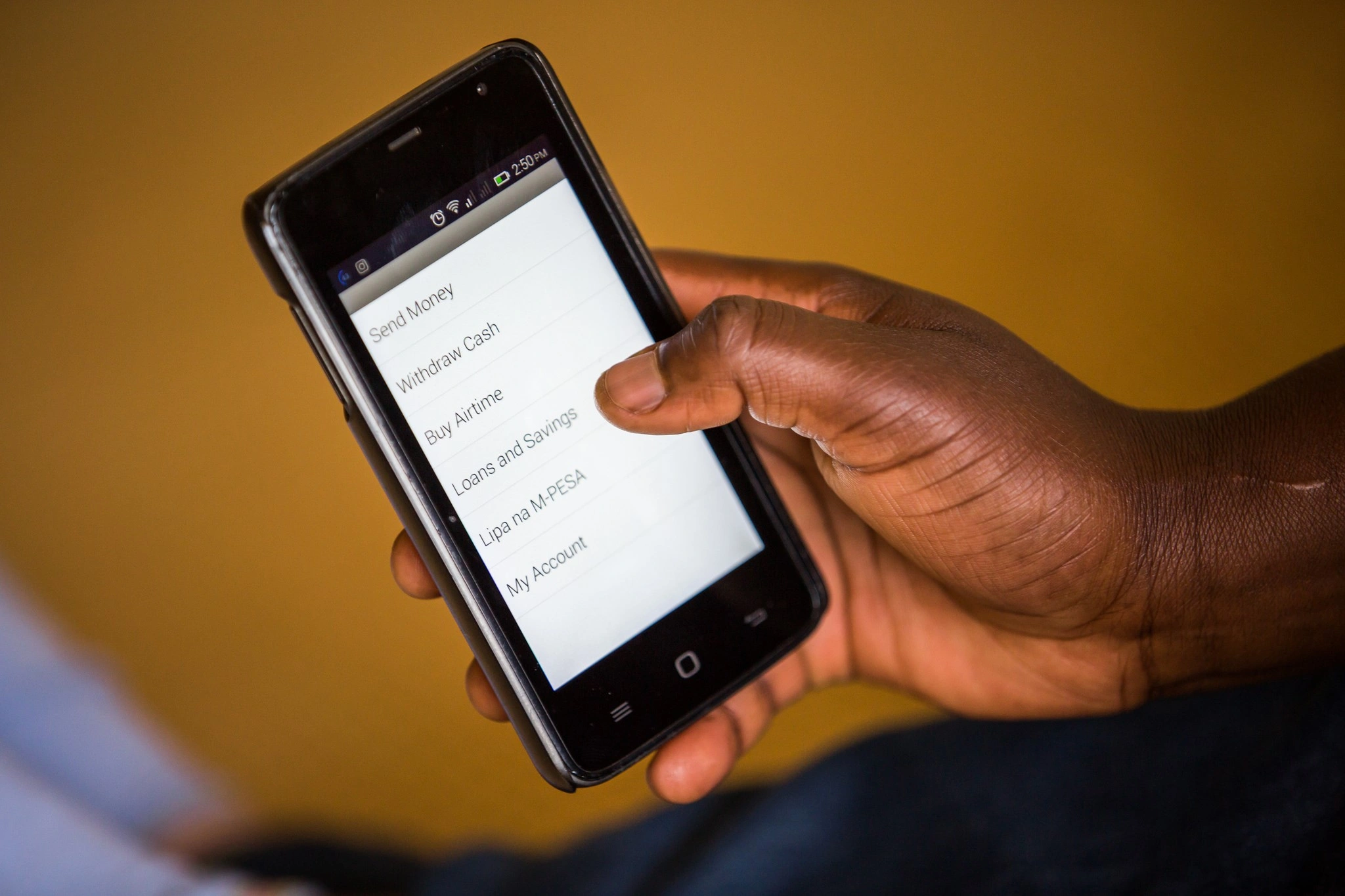

M-Pesa menu on a smartphone. Mobile money also works on the most basic handsets. Picture credit: Vodafone Group

Although there is no other research literature to compare the results with, it was found that past mobile phone behaviour predicts future mobile money adoption and expenditure with reasonable performance.

This research is exciting because it provides data-driven evidence on how M-PESA is being used and the factors that drive its adoption. The findings will help inform future decisions regarding the development and deployment of this service to serve an even wider population and contribute to the economic prosperity of disadvantaged populations outside of the traditional banking system.

The research can be viewed here: https://arxiv.org/abs/1812.03289

The team at Vodafone has since extended this work to other markets and found other implications for service design there, highlighting the power of data-driven decisions.

Liked this post? Here’s what to read next:

Technology, transport and partnership: A roadmap for fighting HIV https://www.vodafone.com/content/vodafone/vodcom/en_gb/home/what-we-do/technology/blog/roadmap-for-fighting-hiv.html

Making mobile money safer and more transparent https://www.vodafone.com/content/vodafone/vodcom/en_gb/home/what-we-do/technology/blog/m-pesa-in-kenya-and-tanzania-awarded-gsma-mobile-money-certification.html