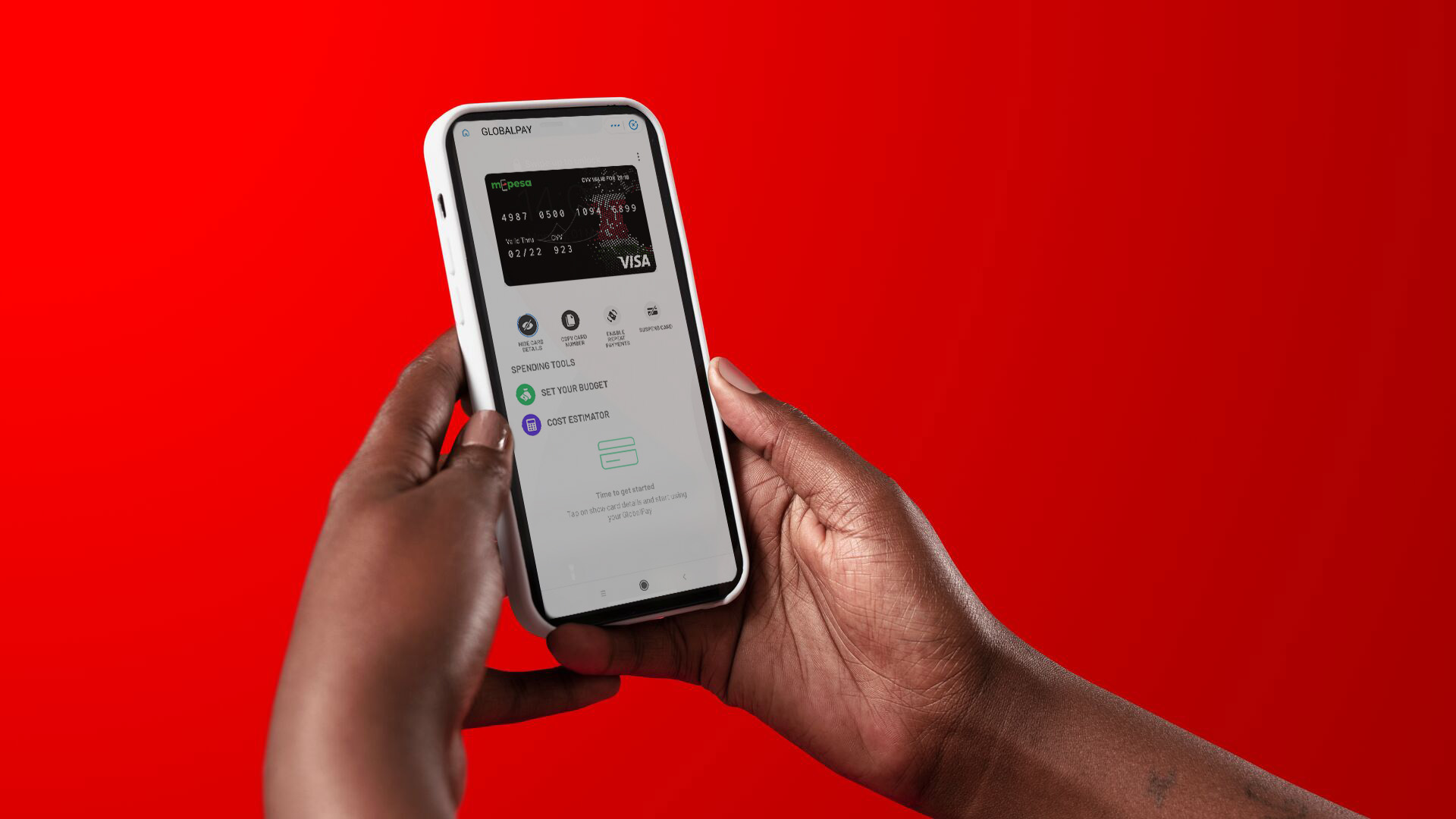

Safaricom and Visa launch ‘M-PESA GlobalPay’ virtual card that enables customers to use M-PESA to shop at more than 100 million merchants across 200 countries for the first time

Safaricom and Visa have unveiled a new virtual card, called M-PESA GlobalPay, that enables customers in Kenya to shop using their mobile money account at more than 100 million merchants across 200 countries through Visa’s global network. This will both open e-commerce opportunities for M-PESA customers and make it easier for Kenyans when travelling abroad.

M-PESA is widely recognised as Africa’s leading fintech platform. Since its launch in 2007, it has grown to serve more than 51 million customers across seven countries, offering a variety of digital financial services including peer-to-peer money transfer, cashless and utility bill payments, micro-loans and savings.

Customers can access the new Visa card through the M-PESA telephone service or via the smartphone app. The card works by enabling customers to generate a unique card verification value (CVV) – the security code on payment cards – which can be used to confirm transactions with merchants online or when travelling abroad. For added security, each unique CVV generated lasts for just 30 minutes and is only accessible once a customer has inputted their M-PESA PIN.

The growth of online shopping in Sub-Saharan Africa is projected to continue as smartphone adoption and access to digital services improves, with leading markets such as South Africa and Kenya becoming increasingly mature.

Peter Ndegwa, CEO, Safaricom said: “M-PESA has, over the past 15 years, evolved from simply money transfer to become a robust payments platform and driver of financial inclusion for Kenyans. This has paved the way for numerous innovative services. By partnering with Visa to provide the M-PESA GlobalPay virtual card, we are looking to bridge the gap for our customers who would like to use M-PESA anywhere across the world.”

Corine Mbiaketcha, Vice President and General Manager for East Africa, Visa said: “Safaricom has already transformed how money moves in Kenya, and we are excited to be working together to develop new and innovative payments products and services that can eliminate barriers to global commerce for merchants and consumers in sub-Saharan Africa.”