Supporting SMEs to thrive

Small and medium sized enterprises (SMEs) are the lifeblood of communities and economies across the globe. They create jobs, spark innovation, and open opportunities for billions of people. We believe it's vital to support these businesses so they can keep driving economic development and provide employment and social mobility, including for women, young people and minorities.

Driving financial inclusion

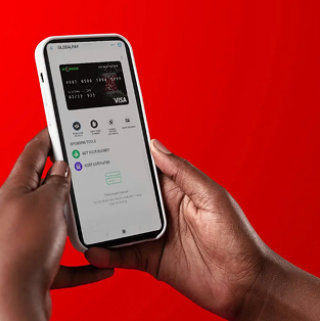

We believe progress must be inclusive to be sustainable. Globally, 1.3 billion adults do not have a bank account, but many of them do have access to smartphones. Mobile services are increasing inclusion in low to middle income countries, but large gaps in account ownership remain among underserved groups. That’s why increasing mobile coverage and access to financial services creates a powerful opportunity to help these people secure their future and unleash their potential. This includes safely and securely saving money, making or receiving payments, starting businesses, and accessing loans and other services – such as insurance.

GOALS

In FY25, we surpassed our goal of connecting 75 million customers in Africa to mobile money and financial inclusion services, which we had set for March 2026.

How we're connecting people to financial services

We're expanding our financial inclusion solutions to keep delivering sustainable economic growth and prosperity, such as growing our pioneering mobile money solutions, including M-PESA. And we're working with banking and financial services partners to empower underserved people in remote areas with access to payments, loans and savings on their mobiles.

Inclusion

{{statusBarTitle }}

{{statItem.prefix}} {{statItem.statNumber }} {{statItem.suffix}}

{{statItem.title || ''}}

{{ statItem.description || '' }}

Inclusion

Financial inclusion across Africa

In 2025, we continued to drive financial inclusion across Africa, reaching 77 million customers, up from 66 million in the previous year. Explore the map for a breakdown.

{{keyword["Map Explore Text"]}}

{{keyword["Mobile Map Explore Text"]}}

Our latest success stories

Revolutionising savings in Tanzania

M-Koba in Tanzania has revolutionised the way people manage their savings by providing a secure, transparent, and convenient platform to over 2 million members, 70% of whom are women. The platform partners with non-profit organisations to focus on empowering women and young people, especially in rural areas, by enhancing financial literacy and digitising savings.

Ensuring equal opportunities to save

In Tanzania, M-Wekeza is changing the way people invest. It's a mobile-based scheme that supports sustainable economic growth by providing customers with secure and convenient ways to grow their money. The service ensures everyone has equal opportunities to invest and save.

Delivering inclusion for informal businesses

Paga Fácil in Mozambique has become a vital service that allows merchants to collect payments from customers with M-PESA accounts from a mobile device. It delivers inclusion and unlocks economic potential by giving access to both formal and informal merchants – the latter of which make up over 80% of the population and contribute around 40% to GDP. Since June 2024, we've onboarded 67,000 merchants with 47,000 currently active.